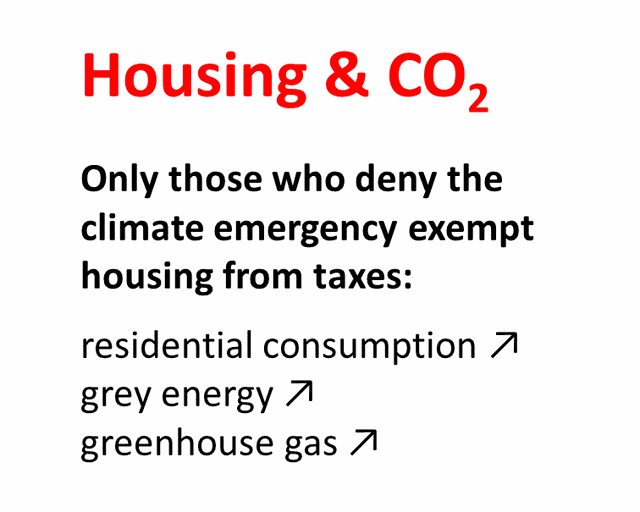

Housing and Climate

Appeal to politicians and climate activists

The 8% residential tax is a forward-looking vision. In this way, housing could be taxed in 2040: Transparent, balanced and environmentally friendly. Should we wait that long for a climate-friendly tax on housing? NO. Climate protection cannot wait any longer. Every new tax law must be compatible with climate policy. We need incentives to reduce CO2 emissions and tax models that make us more sensitive to climate change.

The swiss tax reform 17.400 must prevent excessive private debt. This is important for the stability of Switzerland's financial markets. At the same time, the reform determines taxes for residential property. For the laws to be climate-friendly, an adjustment is urgently needed. Because housing generates a lot of CO2, it is particularly relevant in terms of climate protection. If the law makes it possible to use living space sparingly, the climate will benefit twice: less CO2 because of the grey energy used under construction and less CO2 because of the use of the home.

The 17.400 consultation will continue until 12 July. Here we can fight climate change together. You can download the following questionnaire. The first question is particularly important. A good answer would be: The tax reform must take climate policy into account. Delete the sample answers in blue, enter your own opinion and send the form to Parliament. Also available for download: Templates for the next climate demonstration. Your commitment serves the climate, here and worldwide. If we jointly arrive at a climate-friendly law, we will benefit from it for decades to come.

8 % residential tax...

...because fairness is worth paying for

Rental value 2.0

The agendas of parliamentarians are overflowing. And yet it happens that they can occasionally take time for the worries of concerned citizens. Many thanks to the

National Councillors Beat Flach (AG) and Thomas Hardegger (ZH), to whom we were permitted to introduce the 8% housing tax model.

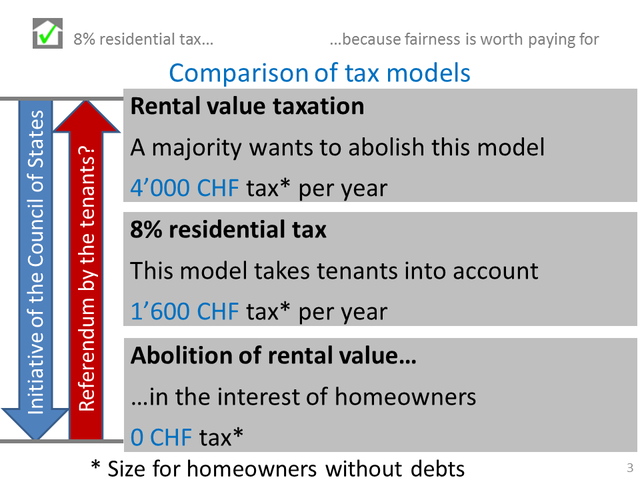

The 8% residential tax is a counterproposal to the rental value abolition. Here, too, the current rental value taxation is replaced, but with regard to the interests of the tenants.

The abolition of rental value is unfair. Tenants and responsible homeowners reject the one-sided tax exemption. This tax reform is likely to fail and the

unpopular rental value taxation will remain in force.

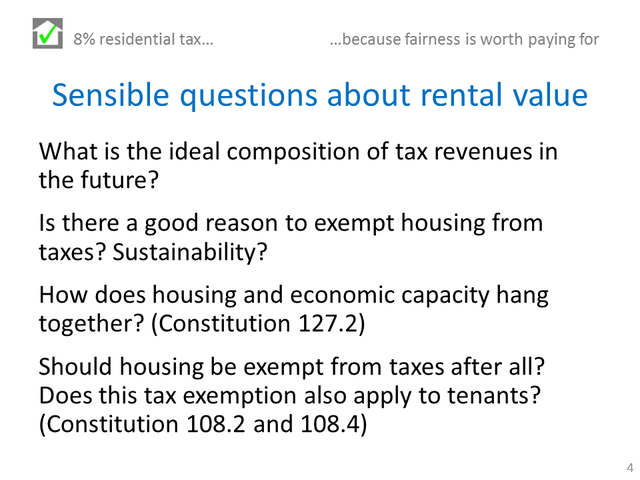

These questions relate to the intention of the Council of States Economic Commission to exempt homeowners from taxes on housing. See the Council of States initiative

17.400.

BfS (Bundesamt für Statistik) = Federal Statistical Office

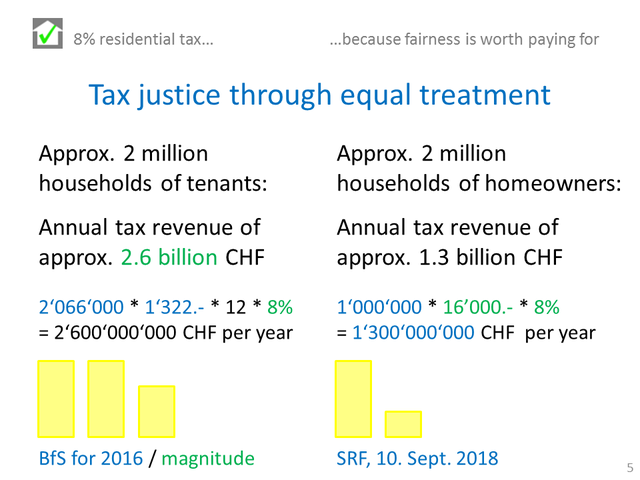

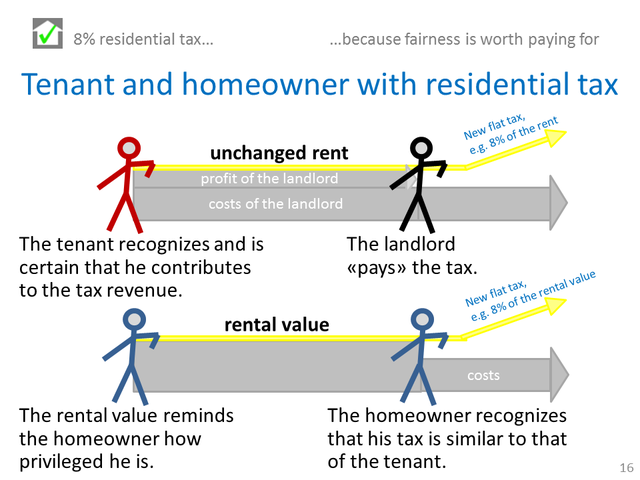

The fact that tenants and homeowners contribute a similar amount to the tax revenue is particularly evident in the case of private rentals. The taxable income is then:

Wage + rental value + rental income - various deductions. Finally, the same tax rate applies to the rental value and the rental income.

Thought game on Initiative 17.400: If you exempt homeowners from taxes on living, why shouldn't you also be able to exempt tenants from taxes on living? Without taxes on rental income, landlords could lower their rents. With 70,000 vacant apartments in Switzerland, it is advantageous to be able to offer an apartment at a lower price.

The differences between tenants and homeowners are smaller than is generally assumed. Although a homeowner pays his taxes directly and the tenant indirectly via the

landlord, the contribution to the state is roughly the same.

The presentation is based on economics. There the imputed rental value is understood as income in kind. In order for the layman to understand the rental value as

well, it can be represented as a fictitious income, i.e. rental value = income that a homeowner would have if he or she rented out his or her apartment.

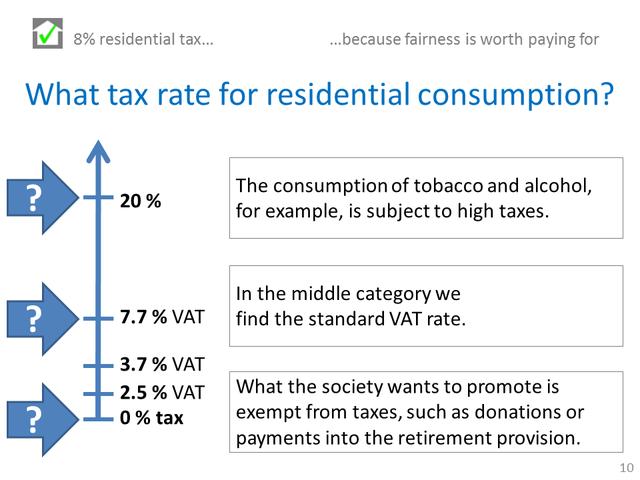

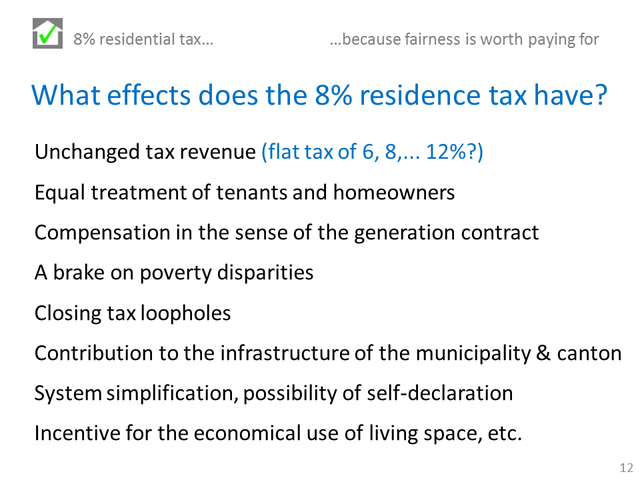

The 8% residential tax no longer wants to tax the rental value as income, but as consumption. This has the great advantage that a moderate tax rate is sufficient and

that tax rates of 20% and more are no longer necessary.

Normal consumption is taxed at approx. 8%. Isn't it obvious to also tax residential consumption at 8%? Is there a better yardstick for residential consumption than

the rental value?

It is clear to all of us that the state depends on a revenue. Knowing that the burden is evenly distributed among many shoulders gives a good feeling.

Flat tax: The tax rate for a budget-neutral tax reform depends heavily on mortgage interest rates. If you look back 15 years, it should be about 4%, if you look back

5 years, about 10% would be correct. 8% is a compromise under the assumption that interest rates will remain low.

It is advantageous for communes and cantons if taxes are levied evenly. After all, their tasks and obligations are constant too.

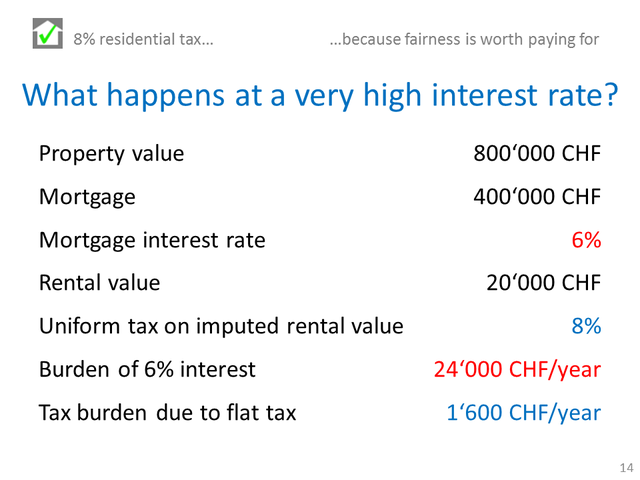

The 8% residential tax is harmless compared to the enormous burden of high mortgage rates. At this point, it should be remembered that rents also increase as

mortgage rates rise.

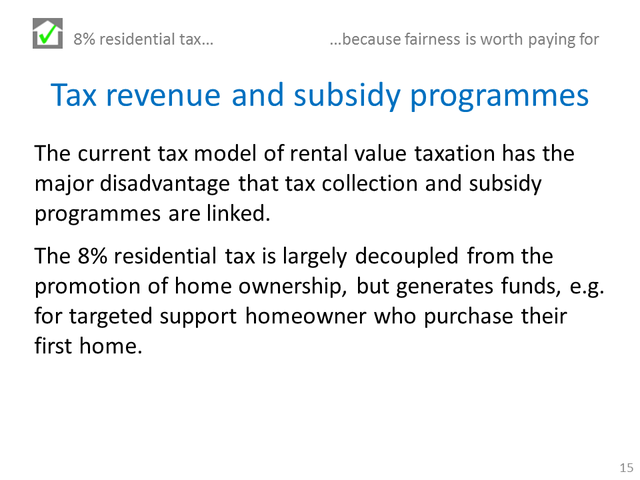

The Constitution provides for the federal government to advocate for cheaper housing, both for tenants and for homeowners. In particular, families, the elderly, the

needy and the disabled shall be supported. (Article 108.4). Promotion is of course only possible if the necessary funds are available.

The 8% residential tax for the imputed rental value ensures that home owners and tenants are treated similarly.

The 8% residential tax for tenants (with unchanged rent) is an option. More facts must be known before such a flat tax can be worked out.

The proposal by the Economic Commission of the Council of States is unfair because it unilaterally exempts homeowners from taxes on living. Tactically, however, it

is clever: if the concept prevails, homeowners can enjoy new privileges. If the concept falls victim to a referendum, right-wing populists will promise another ten years to free us from the

rental value...

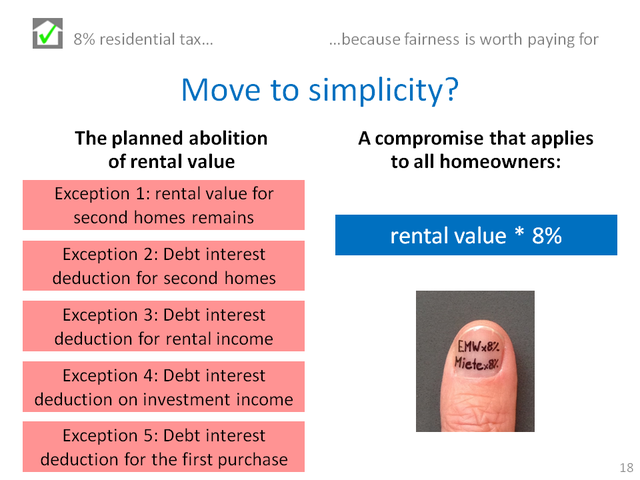

Flat tax at its best: For the tax reform on rental value (EMW = Eigenmietwert), half a thumbnail is sufficient! The second line serves as a supplementary

option...

From left to right: Edwin Drack, National Councillor Thomas Hardegger (Social Democratic Party, ZH), Green Liberal party manager Ahmet Kut and National

Councillor Beat Flach (Green Liberal Party, AG). Thomas Hardegger and Beat Flach, as Vice-Presidents of the Hausverein Schweiz, are very familiar with topics related to living.

From left to right: National Councillor Thomas Hardegger (Social Democratic Party, ZH), Green Liberal party manager Ahmet Kut, National Councillor Beat

Flach (Green Liberal Party, AG) and Stefan Drack. The Vice-Presidents of the Hausverein Schweiz, Beat Flach and Thomas Hardegger, confronted us with critical questions. They recognized the

potential of the 8% residential tax, but also legal and political challenges...